Money, I find it to be a taboo subject for some, but it is something that all folks need to be aware of at any level of income. My parents never discussed money in front of us as children. I only knew when we could and could not afford certain things. I worked since I was 14 and every paycheck was gone before the next arrived. When I went to college I got a credit card in order to keep up with fellow classmates, but never thought much of having to pay it back and found myself only worried about making minimum payments. I then got married right out of school and quickly became pregnant with a pregnancy that rocked my world leaving the Mr’s nominal paycheck at the time for everyday needs. We quickly figured out neither of us have ever worked with budgets and lived paycheck to paycheck. A few years into marriage we knew things had to change, I took the reins and read every book I could find and finally found Dave Ramsey as a method that could work for us. We had one car for a couple of years as maintaining two old clunkers wasn’t feasible. We each had a cash budget and our meals were less than special. During that time we never felt the need for more and fell into a steady pattern. It was a sweet time for us even during the exhaustion of having two babies and the rush of the beginning years of an ever expanding church plant that we were part of. Then in 2008 we knew it was time to make some residual income where we could. That’s when we fell in love with photography and blogging. Wedding photography and blogging soon began to match my husbands salary. We felt rich to say the least and was doing it all as a side business. Regrettably, we also began to spend that way too. We were young and full of energy. We bought a house we technically should have never purchased, finally purged all the hand me down furniture we owned, and I felt the need to buy more in order to have more blog content. We then went through a huge audit where we discovered photography was not a service, but considered a product. We owed tons in back sales tax. We were then working none stop just to make ends meet once again. We went back to the Dave Ramsey method and have stuck with it pretty much since. My husbands salary has gone up over the years and photography and blogging has become less of a need for survival and more an outlet of passion. We don’t make much with either any longer, but it does afford us a good vacation or two a year. Finically, we were making it happen but as we have gotten older we have new goals in mind. Like a retirement plan that we haven’t quite poured into like we should, home renovations that I know won’t be feasible once the kiddos start driving in the next few years, and let’s not get started on college. In order to make these goals happen we knew we needed to shift our finances again. To see where some extra money could open up to make our dreams into reality. Thankfully our time doing Dave Ramsey has set us into a pattern of living debt free minus our house and one car payment. We have spent time saving and our emergency fund hasn’t had to be dipped into in years. All last years freelance income was set aside for medical bills for little man and we forged any big vacation plans. We are in a good place to jump ahead and make things happen without too much financial stress, but still need to be wise on how to bring our goals into existence without going above and beyond what we bring home monthly.

A few practical steps we have taken to plan for our financial goals ~

We do the Dave Ramsey method

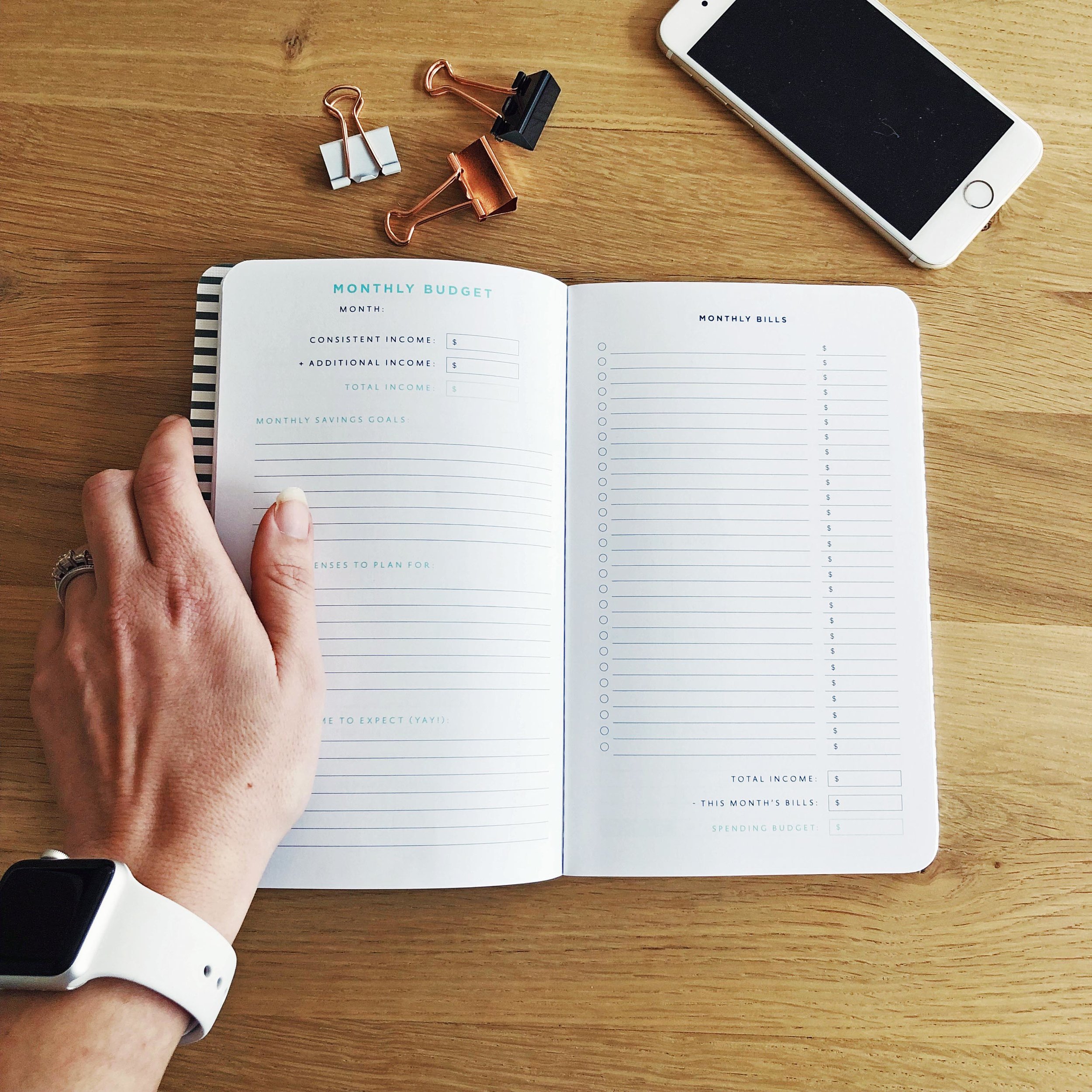

we know where each dollar goes {I have used this budget planner for years now}

this means I took every bill that we pay and wrote it down. Yes, that includes the target card bills that normally don’t count. I also found myself surprised at the dollar amount that snuck in there the last few years in little ways.

We are presently reviewing what can be cut and where we can save. Asking ourselves questions such as can we cut our food budget down some? Can we do away with cable again? Do we really use that gym membership enough to justify the expenditure?

Our intention is to see if we can find enough money, by simply cutting back to help us get to our next planned saving goal

I opened saving accounts for both our children

I put a certain amount away every month. Sometimes it’s larger, but the minimum is set. My hope is that it will alleviate some of the bigger expenditures we will have for them in the future.

I realized having a spending goal with their name on it helps remind me that planning for their future, and in turn ours, is an intentional one and not just me hoping there will be enough in our regular savings to cover it when that times come.

Ellie likes to add to hers with birthday and holiday cash gifts

Little Kellen has no idea his even exists, because I know he will want to spend it on nonsense and won’t quite understand the concept of this is for his future.

For home renovation goals

I put together a “needs” list and “dream” list

Need - remove dead trees before they fall on the house

dream - give the kitchen a major face lift

I am putting numbers to the lists and see what is feasible or not. I then alter my expectations to see where it would fit comfortably in our budget. This also puts my patience to the test, as I know the timing of it all may not work out like I always hope.

I always see what I can do myself. Such as for the laundry closet I knew electrical and plumbing needed to be hired out, but we could handle the painting, woodwork and wallpapering.

I know most of you probably have your own finances well planned out, but those who don’t and those who are entering adulthood I encourage you to make a realistic financial plan that allows you to stay our of debt. Most importantly always to remember to include your dreams. At 23 we always had hopes of traveling well, eating well, and not live paycheck to paycheck. Fast forward, and now we can see our hard work and planning has opened the doors to such things even if they seem so simple now. We achieved our dream lifestyle by working hard and planning well even when we had to overcome setbacks. Today our dreams are a little larger in scale and we hope our past diligence will again pay off for the future.

“Suppose one of you wants to build a tower. Won’t you first sit down and estimate the cost to see if you have enough money to complete it?” ~ Luke 14:28